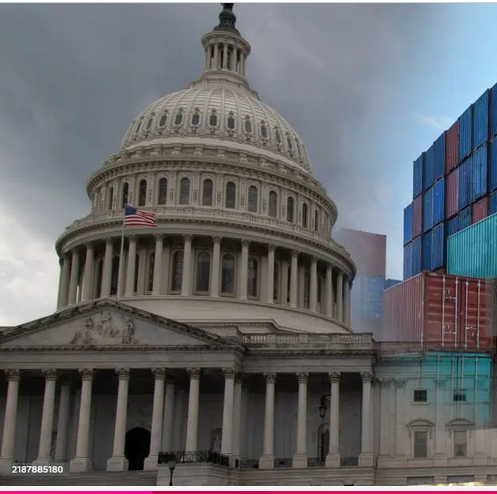

Echoing the pattern of compensation throughout the region, Chinese and Hong Kong equity markets made up on Tuesday brought shares, both down sharply, to power the move higher after the previous day session marked by a big sell-off blamed largely on fears over fresh trade tariffs enacted recently.

Indices Suffer Heavy Losses, Markets Rally

The Shanghai Composite Index was 0.9% higher at midafternoon, and the CSI 300 index of leading blue chips gained 1.0%. This was after both indices dropped more than 7% a day earlier. Likewise, the Hong Kong Hang Seng Index rose by 1.6%, after losing 13.2% in the previous session, the largest single day decline for the index since the 1997 Asian Financial Crisis. The Hang Seng Tech Index gained 3.6% following a 17% drop on Monday.

Market stabilizing government support measures

According to the Wall Street Journal, the authorities in Beijing may have gotten more aggressive in stabilizing the market in response to the US’s new 34% tariff on Chinese goods. Well, China did what any country would do, they retaliated with reciprocal tax on imports from America. China, which said Tuesday it would place a further 50% duty on U.S. imports from China, refused to submit to what it called “blackmail.”

In an effort to bolster confidence in the market, Central Huojin Investment — dubbed the “national team” — and said it had acquired stakes in China-listed companies through exchange-traded funds. Everything to maintain orderly capital market and hence fund announced plan for more stock. Also, the holding companies of shares from China’s note, as a number of services have been noted about share ban noticed that some of the listed businesses have made some moves to enhance their share investments.

Analysts Should Watch Market Stabilization

Analysts said that the establishment of the potential for institutions such as Central Huijin to further increase their share can become a stabilizing force in the upper layer of the market, as the time of sharp rise and fall approaches. It has been shown that such long horizon capital inflows may be depressing equity risk premiums

Regional markets started on a positive note

Sentiment overall during Tuesday’s Asia trade was a touch better. The rebound of some of the heavy loss of late was helped by some cautious optimism over negotiation of the soon to be announced tariffs, as well as the intervention of policymaking. Japan’s Nikkei 225 index soared 5% in a wider move for markets. Meanwhile shares in Asia-Pacific ex-Japan gained 0.2 percent in MSCI’s broadest index. Maybe these shifts reflect a more cautious return to calm across the region following the recent market turmoil.