Over two decades, Abel turned that business into one of Berkshire’s crown jewels, delivering steady growth and returns. His deep understanding of regulated industries and unflinching focus on efficiency made him a favorite of Buffett’s inner circle—and set the stage for his promotion to vice chairman of non‑insurance operations in 2018.

Mastering the Art of Patience and Partnership

Abel’s leadership style echoes Buffett’s famed patience, but it also carries its own mark. He believes in forming lasting partnerships with management teams, empowering local executives to run day‑to‑day operations while Berkshire provides capital, strategic support, and a tolerance for long horizons. Under his watch, Berkshire Hathaway Energy doubled down on renewable energy, launching some of the largest wind and solar projects in U.S. history—moves that blended Buffett’s value‑investing ethos with his appetite for innovation.

Perhaps no deal better illustrates his approach than Berkshire’s foray into Japan. In 2020, Buffett tapped Abel to lead discussions with Mitsubishi, Mitsui, Sumitomo, Itochu, and Marubeni—five trading behemoths in need of stable, long‑term shareholders. Abel negotiated substantial stakes in each, a bold overseas pivot that most observers thought uncharacteristic for Berkshire. Yet those investments have proven resilient, and Abel tells shareholders he expects to hold them “for decades.”

The Road to Succession

Succession is a topic Buffett and his late partner Charlie Munger treated with unusual transparency. In 2021, at a shareholder meeting, Munger confirmed rumors that Abel—rather than another vice chairman, Ajit Jain—was chosen to succeed Buffett. That early reveal gave investors, employees, and the 60‑plus executives running Berkshire’s sprawling empire time to prepare.

Buffett himself has been effusive in his praise: “Greg is ready,” he told CNBC veteran Becky Quick. “We’ve known it for a long time.” Board members like Ron Olson echo that sentiment, noting Abel’s steady hand and unshakeable integrity.

What Abel’s Leadership Could Mean for Berkshire

Investors are already speculating on how Abel might steer the ship. Some expect a greater emphasis on renewable energy and utilities—areas he knows intimately. Others wonder whether he’ll adopt new technologies or push further into global markets. Yet early signals suggest Abel will honor Buffett’s core principles: buy high‑quality businesses at fair prices, recycle cash into still‑better opportunities, and resist the siren calls of short‑term trading or fads.

Analysts also point to Abel’s calm demeanor as an asset. In a corporate world prone to sudden swings and headline‑grabbing drama, his low‑pressure style may reassure shareholders accustomed to Buffett’s measured cadence.

Balancing Legacy and Innovation

Taking over from Buffett—a man whose annual shareholder letters read like business philosophy roadmaps—is no small task. Abel will need to balance the founder’s time‑tested playbook with evolving market realities: digital disruption, climate change, and shifting consumer habits. His track record suggests he’s ready. At Berkshire Hathaway Energy, he championed smart grid technologies and battery storage long before they became mainstream

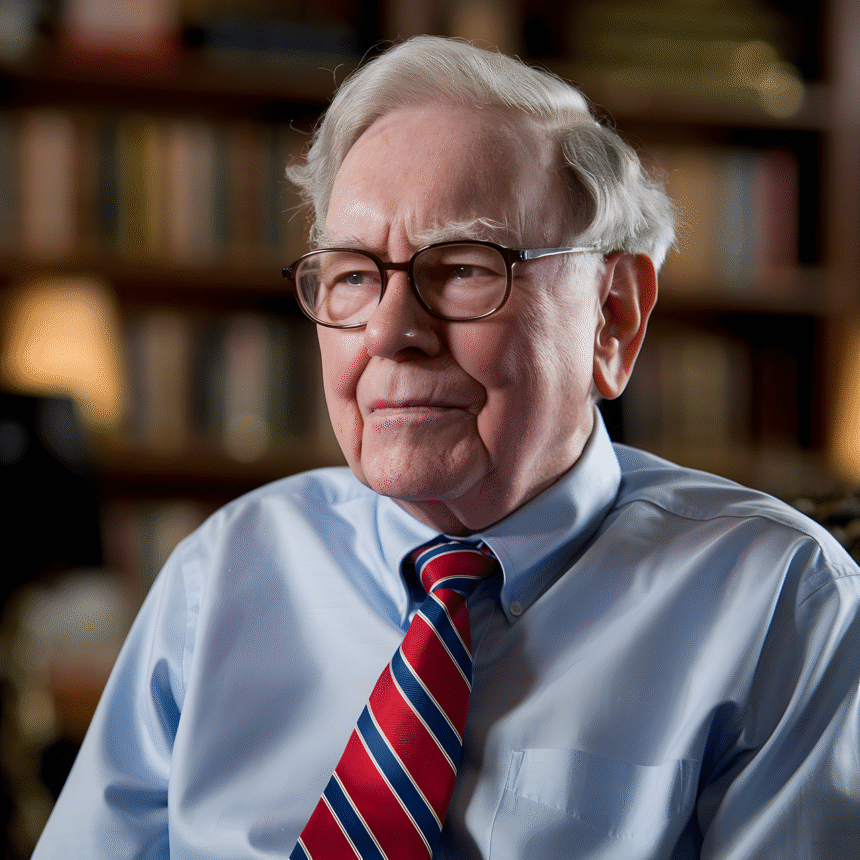

Come the end of 2025, Warren Buffett—often called the “Oracle of Omaha”—will hand over the helm of Berkshire Hathaway to Greg Abel, a trusted lieutenant with more than twenty years under Buffett’s wing.

Abel, 62, has been a Berkshire board member since 2018 and currently serves as vice chairman overseeing all non‑insurance businesses—from power plants and pipelines to railroads and retail outlets. His journey began well before that title: in 1999, when Buffett’s company acquired a controlling stake in MidAmerican Energy, Abel was already a top executive there.

He told shareholders at the annual meeting that he expects those Japanese investments to remain in the portfolio for decades—a sign of his long‑term thinking.

Buffett and his late partner Charlie Munger first signaled Abel’s future role back in 2021, giving investors a rare glimpse into succession plans years ahead of time. “Greg is ready. I have no doubt about that,” longtime director Ron Olson told CNBC, echoing Buffett’s own confidence.

A native of Edmonton who studied at the University of Alberta, Abel shares more in common with Buffett than just geography—he’s also a dyed‑in‑the‑wool hockey fan. In fact, Buffett once revealed that in the 1990s they lived only a few blocks apart in Omaha, yet didn’t cross paths until Berkshire brought them together.

As 2025 approaches, all eyes will be on Abel to see how he carries forward Buffett’s legacy while putting his own stamp on one of America’s most storied companies.

READ ALSO: Measles Alert: We’re Living in a ‘Post-Herd-Immunity’ World as Outbreaks Surge