Fast-track status is in the middle of a daring economic and diplomatic gambit being pondered by Trump administration officials, who are discussing the possibility of giving sovereign wealth funds from the Gulf states — specifically the United Arab Emirates (UAE), Saudi Arabia, and Qatar — a special fast-track status to invest in the United States. This effort, in its nascent planning stages, has the potential to unlock billions of dollars worth of capital flows and represent a sea change in U.S. foreign investment policy.

People with knowledge of the internal deliberations indicate that the White House is considering a proposal to streamline the activities of the Committee on Foreign Investment in the United States (CFIUS), the federal agency responsible for reviewing the national security implications of foreign investments in U.S. businesses and infrastructure. If the proposal moves forward, Gulf wealth funds could enjoy quicker review timelines, fewer bureaucratic hurdles, and a more welcoming investment environment in key American industriesunder a fast-track status.

Read More: US-Imposed Tariffs Slash: Malaysia’s Bold Strategy for Trade Victory

Gulf Wealth Funds: Economic Powerhouses Set for US Growth

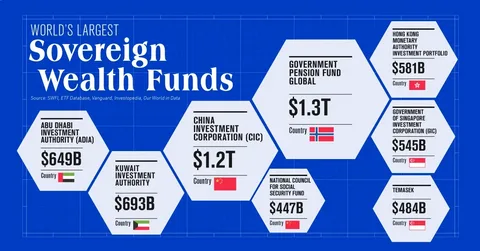

Saudi Arabia, UAE, and Qatar sovereign wealth funds collectively oversee an estimated $3 trillion+ in assets worldwide, making active investments in growth sectors like technology, real estate, clean energy, and infrastructure. These funds are more than mere economic tools—they are geopolitical weapons Gulf states use to project their power and gain long-term strategic positions.

The Trump administration’s decision to possibly expedite agreements with these funds has been viewed as a bid to draw high-volume foreign investment that can fuel job creation, repair crumbling infrastructure, and aid tech innovation in America. Additionally a fast-track status, it can motivate Gulf countries to prefer U.S. markets over alternative locations in Europe or Asia.

Strategic Alliances Strengthened Through Economic Policy

Apart from the economic rewards, this policy change is filled with geopolitical meaning. Gulf countries have long cooperated with the United States on key global challenges—particularly in defense, energy, and regional security. By establishing a fast-track status for direct investment, the U.S. is renewing its dedication to these relationships when power dynamics in the world are changing.

In an era when the competition between the U.S. and China is escalating, and international capital is getting more competitive, drawing long-term investment from reliable allies in the Gulf is both an economic and strategic objective. The fast-track strategy might send a powerful signal of trust and cooperation to leading actors in the Middle East.

Security vs. Investment: A Delicate Balance to Maintain

Nevertheless, the proposal is not risk-free. Opponents, such as lawmakers and national security personnel, warn that easing the CFIUS process would leave the United States vulnerable to foreign control in critical industries, such as defense technology, telecommunications, and energy infrastructure. These industries are frequently the focus of hostile foreign interest and intellectual property theft, and therefore regulation is essential.

Supporters believe that any expedited fast-track status would still need protections, rigorous vetting, and industry-specific limits to guarantee national interests are still safeguarded. “It’s about making smart investment decisions without compromising our security,” said one official, pointing to the requirement for balanced reform, not loose deregulation.

What This Could Mean for the Future

While no decision has been reached, giving fast-track status to Gulf wealth funds would greatly enhance U.S. attractiveness as a high-end investment destination. This policy action would coordinate economic growth with foreign policy, indicating a more pragmatic and business-friendly orientation in the White House.

The world will be paying close attention as these initial-stage talks develop. If managed well, this has the potential to become a model for targeted investment diplomacy, bolstering both the U.S. economy and its relationship with key Middle Eastern allies.

Ultimately, the Trump administration’s proposal to offer Gulf wealth funds a speedy entry into U.S. markets is not merely a monetary adjustment — it’s a declaration of strategic positioning, economic drive, and diplomatic creativity. Provided that the U.S. maintains strict national security vetting, this innovative policy change has the potential to redefine the future of foreign investment in America.

For More Trending Business News, Follow Us 10xtimes News