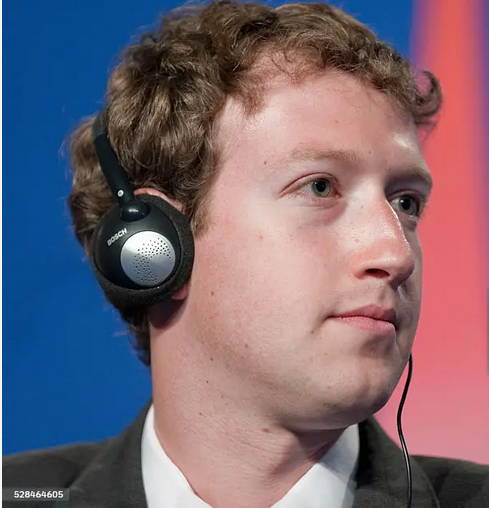

Mr. Mark Zuckerberg, head of Meta, has been out defending his company in a landmark antitrust trial over allegations it is providing what amounts to a social networking monopoly. His testimony began on Monday in a Washington DC federal court in a case with the FTC that dates back to 2020. The US competition regulator has alleged that Meta illegally built a monopoly by snapping up the photo-sharing app Instagram in 2012 and the messenger service WhatsApp in 2014.The proposed remedy from the FTC is structural, requiring Meta to divest from either Instagram or WhatsApp. Meta, in turn , countered that the social media space was very competitive and cited competitors such as TikTok, X (the site previously known as Twitter), and YouTube.

Mr. Zuckerberg was asked about court-released messages from 2011 and 2012. An email written in 2011 noted Instagram growing quickly. One in 2010 focused on a concern that Meta’s was losing ground (FB) in text messaging, and another in 2010 discussed light exposure. Mr. Zuckerberg said these discussions were “pretty early” discussions around the idea of acquiring Instagram. It was noted that since Meta bought Instagram, they have made it better.

In opening remarks, FTC attorney Mr. Daniel Matheson said that Meta, then known as Facebook, viewed the acquisition of Instagram for $1 billion and WhatsApp for $19 billion as “defensive acquisitions,” believing “competition is too hard.” In reaction, Meta’s lawyer, Mr. Mark Hansen, called the FTC lawsuit “misguided.” The suit alleged that when Meta, then known as Facebook, acquired Instagram and WhatsApp, the company wanted to “grow and integrate them with Facebook.”

A 2012 internal memo from Facebook founder Mr. Zuckerberg, referring to “neutralizing” Instagram, was “damning evidence,” Mr. Matheson said. However, Meta argued that these acquisitions ultimately benefited consumers through improved services. He said his firm had never before viewed purchases as impossible if the goal was to upgrade something and develop it.

In total, Meta says its platforms have 3.27 billion daily active users. EMarketer projections suggest that more than half of Meta’s US advertising revenue will come from Instagram in 2025.

Acquisition history

One big tech acquisition was Meta (then Facebook) , acquiring Instagram back in 2012 for $1 billion. It was part of a fast-growing photo-sharing app with hundreds of millions of users and minimal revenue back when Reel was still largely in the pipeline running through Instagram. Similarly, the 2014 $19 billion acquisition of WhatsApp gave an insight into how messaging platforms were going to become strategic. WhatsApp already had over a billion users internationally and was touted to have end-to-end encryption and user privacy features. When the acquisitions closed, regulators took notice.

The Book Market Case for Competition

Meta responds that social media is a competitive and evolving space. It points to TikTok as the great success story of short-form video. A well-respected source of the info — it writes — X (the former Twitter) is spot on heaven for catching the information and sharing your opinion и the globe accordingly. While YouTube will never stop being a video platform, in reality, you can make a decent case that it’s a social network as well, where people engage and share content. Meta argues that these and other platforms, such as TikTok, are clear indications of a competitive market, and that claim alone negates accusations of a Meta monopoly.

FTC View on How Markets Work-Some key Insights

On the contrary, the Federal Trade Commission has an entirely different approach to viewing the social media competitive landscape. Meta’s acquisitions of Instagram and WhatsApp allegedly eliminated potential future rivals, according to the regulator. The FTC states that Instagram and WhatsApp could have evolved to become stronger competitors to Facebook as a result of these acquisitions, which would have driven more innovation and given consumers more choices. As the FTC argued in its case, Meta did not just buy the companies and improve their services but also to take away competitors that might one day grow up and challenge those services.