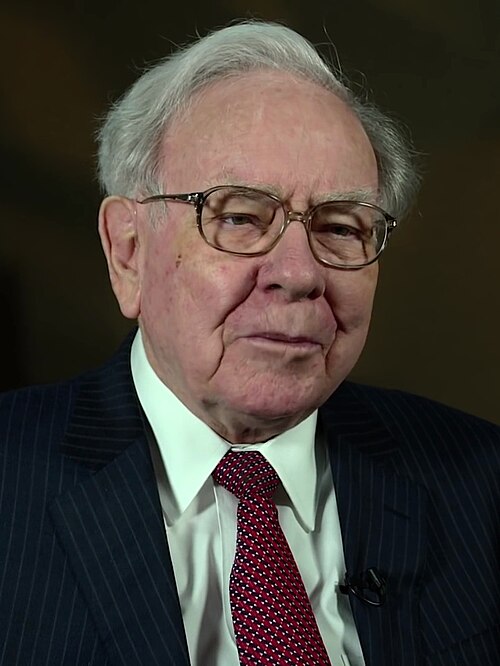

Berkshire Hathaway shares took a sharp hit on Monday, tumbling nearly 6% after Warren Buffett stunned investors by announcing he would step down as CEO. The selloff was also fueled by a weaker-than-expected earnings report, adding uncertainty to what has otherwise been a strong year for the investment giant.

The announcement came during the company’s closely watched annual shareholder meeting in Omaha, Nebraska. After more than six decades at the helm, Buffett revealed that Greg Abel, currently vice chairman of non-insurance operations, will take over as CEO starting January 1, 2026. Buffett, who is 94, will stay on as chairman of the board.

“I feel good about handing things over,” Buffett told shareholders. “Greg is ready, and the company is in a strong position.”

Still, the news sent shockwaves through Wall Street. Berkshire Hathaway’s Class A shares dropped 4.9% to $769,593. Class B shares saw a similar fall, closing at $513.17. Both had recently reached record highs, underscoring how unexpected the announcement was.

A Legacy Like No Other

Buffett’s exit marks the end of an era. When he first took control of Berkshire Hathaway in the 1960s, it was a struggling textile business. Today, it’s a powerhouse worth nearly $1.2 trillion, with holdings across industries including insurance, energy, railroads, manufacturing, and retail.

Despite Buffett’s age, many investors believed he would remain actively involved for as long as possible. His decision to formally pass the reins has sparked concern—not necessarily because of doubts about Greg Abel, but because Buffett’s presence has long been seen as a stabilizing force.

“This is the most transparent transition possible,” said Macrae Sykes, a portfolio manager at Gabelli Funds. “Having Buffett stay on as chairman is important. It gives investors confidence that he’ll still have a hand in major decisions.”

As Berkshire Hathaway embarks on this new era, investors are closely watching how Greg Abel will steer the ship. His leadership style, strategic priorities, and ability to preserve Buffett’s long-term vision will be key to maintaining investor confidence.

Earnings Add Pressure

As if the leadership news wasn’t enough, Berkshire Hathaway also reported a disappointing first-quarter earnings report. Operating earnings fell 14% from the same period last year, largely due to a steep drop in insurance underwriting profits. A key driver of the decline was a $1.1 billion loss tied to the wildfires in Southern California.

Insurance has long been one of Berkshire’s most dependable segments, so the drop stood out. While the company still enjoys a fortress-like balance sheet and huge cash reserves, the earnings miss raised short-term concerns. Buffett’s long-term vision will be key to maintaining investor confidence.

“Buffett leaves behind a company with a strong foundation,” said Brian Meredith, an analyst at UBS. “But there’s no question that this was a rough quarter, and the leadership shift adds to the uncertainty.”

What’s Next for Berkshire Hathaway?

Greg Abel’s promotion didn’t come out of nowhere. He has long been considered Buffett’s chosen successor and has been deeply involved in day-to-day operations. His background in managing Berkshire’s sprawling businesses gives investors hope that the transition will be smooth.

Even with the selloff, Berkshire shares have risen nearly 19% in 2025, outpacing the broader S&P 500. The company’s diversified portfolio, especially its cash-generating businesses like Geico and BNSF Railway, continues to offer stability during volatile times.

For now, investors will be watching closely to see how Abel steps into his new role and whether the company’s famously conservative strategy continues to pay off in a changing market landscape.

READ ALSO : Billionaire Ray Dalio Issues Dire Warning: Trump’s Explosive Tariff War Could Spark a US Recession—Or Something Worse