Nvidia’s earnings report left the markets stupefied. The company proved strong in facing very stringent U.S. export controls on China. Accordingly, it happened to begin fiscal 2026 with revenue estimates that soundly surpassed predictions. In proving once again the reason why NVIDIA is a great player in AI chips, the world’s top semiconductor firm was expected to take an $8 billion hit because of the china restrictions, but Nvidia shares soared up after hours. It further shows how Nvidia continues to shape the future of AI and data centers in conjunction with global GPU innovation.

Although it took a charge of $4.5 billion on unsold H20 chips and had reduced revenue from China, investors held confidence in Nvidia’s long-term growth. Strong global demand and robust strategic planning convinced them of that. Clearly, Nvidia doesn’t just survive but thrives amid the shifting global policies. Technology and leadership in AI keep Nivdia right in the spotlight of semiconductor supremacy. The stock of Nvidia has actually tripled over the year, which is proof of how vital the company is to the ongoing AI revolution.

Read More: Salesforce Acquires Informatica: AI Data Gamechanger Deal

Nvidia’s Revenues Beat Forecast Despite Possible China Export Losses

Nvidia gained Q1-fiscal 2026 revenues amounting to $44.1 billion, upward over Wall Street’s estimated value of $43.3 billion. Nvidia also had a slightly lower-than-expected adjusted EPS of $0.81; this was due to nonrecurring $4.5 billion charges resulting from unsellable H20 chips under the New U.S. restrictions on exports. Had the company not reported the charge, Nvidia would have recorded an adjusted EPS of $0.96, which would have skyrocketed in comparison to last year’s $0.61 per share. Most importantly, Nvidia’s data center section-a backbone for AI development-gives $39.1 billion, just below the estimates but almost double that of last year. Therefore, it has become apparent how Nvidia is benefiting from the increasingly strong demand for generative AI infrastructure, notwithstanding the disruption in sales to China.

China Curbs Hit Nvidia, But Stock Still Rises

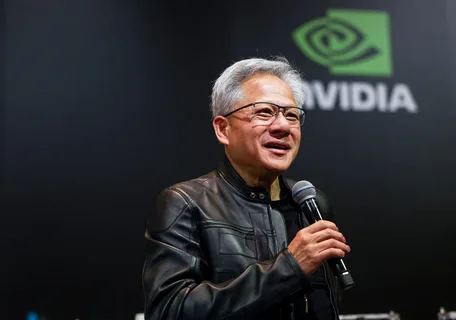

The NVidia AI chips, particularly the most recent H20 model, were previous permit capabilities. Today, it faces stricter licensing with regard to the export of chips to China. This very much micro-directly led to an expense for Q1 and a forecast against an $8 billion potential loss in Q2 revenue. However, Nvidia’s stock enjoyed gains between 4-5% in after-hours trading. Why? Because of stockpiling by Chinese clients of H20 chips that minimized the immediate effect of this latest embargo on exports. Chief Executive Jensen Huang accepted that concern about future impact is pretty big: “The $50 billion marketplace for AI chips in China is now pretty much unavailable for Nvidia.” Nonetheless, the company has plans to develop new and compliant products for that region. More importantly, its non-China demand remains incredibly high, which is why Nvidia continues to thrive internationally.

Also Read: In-Car Software Shake-Up: Amazon-Stellantis Deal Fizzles Fast

U.S. Policy Shakes Global Chip Supply Chain, Nvidia Responds

America’s semiconductor industry is finding itself under new constraints because of the crackdown on technology exported to China. Nvidia had to stop shipments of H20 chips by April due to the unsold inventory built up as a result of lost orders. Jensen Huang warned: “It is clearly incorrect to assume that China cannot develop its own chips for AI. He pointed out that Huawei has been making strides in chip design. But even in this geopolitical heating up, Nvidia now has an intelligent approach: focus on innovation, expand globally, and improve one’s own supply chains outside China. The market allows Nvidia even in the event of a key region being locked out, believing that it can adapt and outperform. It is adaptation that keeps Nvidia ahead in the AI chip war.

Global Hyperscalers-Increasingly Driving Nvidia Growth in the AI Boom

Nvidia’s prediction of $45 billion in sales for the second quarter-along the lines of the $8 billion loss that reflects sales losses due to China-will not fall because of headwinds. It speaks to the enormous demand with global hyperscalers like Amazon, Google, and Microsoft; these firms now account for about 50% of Nvidia’s current data center sales, investing heavily in AI infrastructure. Also, they link the AI deployment cycles with the international race to GPU superiority in order to maintain excitement around Nvidia’s future. Now, despite accounting for only 12.5% of Nvidia’s total revenue, China is one of the countries where the company plans to make a big bet. Nvidia is now more than just a chipmaker-it is the backbone of the AI future.

It’s strategic strength and deep trust in the marketplace, always to show that Nvidia could, even with billions lost from export regulations, beat expectations. Built for anything, Nvidia comes through not only with an unmatched grip on AI chip technology but also with flexible modalities of surviving and thriving in global markets.

For More Trending Business News, Follow Us 10xtimes News