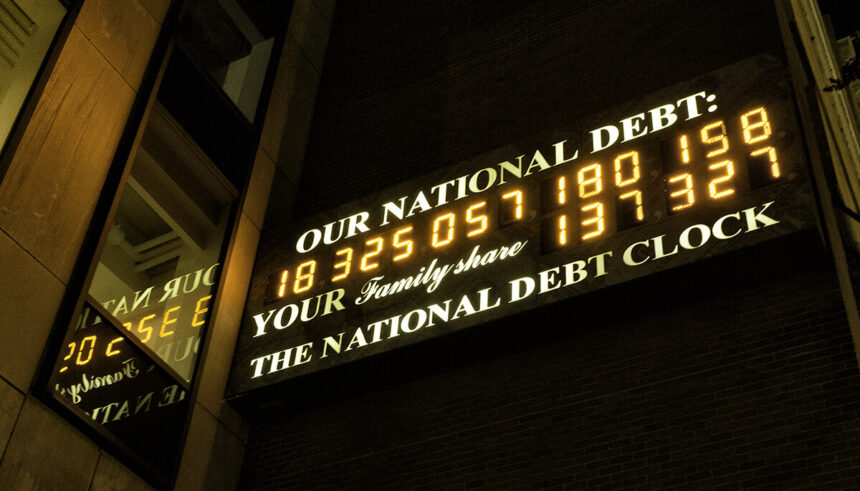

The US dept has a staggering $36 trillion national, which is growing at a rapid rate. A key congressional committee approved President Donald Trump’s tax cut bill. If passed in the House of Representatives later this week, the bill could add up to $5 trillion to the national debt. This follows a recent downgrade of the US credit rating by Moody’s due to concerns over the growing debt.

Currently, the US holds the highest national debt globally. This raises serious concerns about the nation’s fiscal stability in the long term. As of now, the debt stands at $36.2 trillion, which is 122 percent of the country’s GDP. This ratio is increasing by about $1 trillion every three months, further exacerbating the debt problem.

Trump’s Tax Cuts Could Add $5 Trillion to the National Debt

The national debt soared during the COVID-19 pandemic in 2020, peaking at a 133 percent debt-to-GDP ratio. Despite being one of the top 10 countries with the highest debt-to-GDP ratio, the US continues to manage its finances by borrowing large sums of money.

The US government creates a deficit when its expenditures exceed its income. To cover this deficit, it borrows money, leading to the creation of a debt ceiling. The debt ceiling limits the amount the government can borrow, which is subject to congressional approval. Since 1960, Congress has raised or suspended this ceiling 78 times, allowing for more borrowing.

Also Read: Invest Qatar Launches $1 Billion Incentive Programme to Accelerate Investment

The federal deficit measures how much more the government spends compared to its revenue. During Trump’s first term, the deficit increased sharply, especially in 2020. This surge was due to massive government spending during the pandemic, while tax revenues fell dramatically. Under President Bill Clinton, the US saw a federal surplus due to favourable economic conditions and tax hikes.

Understanding the US Debt

When the government needs to borrow money, it sells Treasury bills, notes, and bonds. These are essentially loans from investors to the US government. Treasuries have been considered a safe investment due to the low risk of the US defaulting on its debt. The government repays these loans with interest, depending on the maturity of each security.

Treasury bills (T-bills) are short-term debt securities that mature within one year. Treasury notes (T-notes) are medium-term, maturing between 2 and 10 years. Treasury bonds (T-bonds) are long-term securities, with maturities of 20 to 30 years. These various securities help the government manage its debt.

Of the total $36.2 trillion US debt, $27.2 trillion is held domestically. This includes $15.16 trillion by US private investors, $7.36 trillion by government agencies, and $4.63 trillion by the Federal Reserve. Warren Buffett, through his company Berkshire Hathaway, is the largest non-government holder of US Treasury bills, valued at $314 billion.

The Role of Foreign Investors in Financing US Debt

Foreign investors hold the remaining $9.05 trillion, representing 25 percent of the debt. Over the past five decades, the share of US debt held by foreign entities has increased dramatically. In 1970, only 5 percent of the debt was held abroad. Today, this has grown to 25 percent, with countries like Japan, the UK, and China holding large portions of US treasuries.

Japan is the largest foreign holder, owning $1.13 trillion in US debt. The UK holds $779.3 billion, while China’s holdings amount to $765.4 billion. Other significant holders include the Cayman Islands ($455.3 billion) and Canada ($426.2 billion). These countries buy US debt as a stable investment for their foreign currency reserves and to manage exchange rates.

Read More: Etihad Airways Q1 2025 Performance: Highest Ever Profit and Growth

Recently, Japan and China have used their significant holdings of US treasuries as leverage in trade negotiations with the US. Japan’s Finance Minister mentioned that its holdings could be a bargaining chip in trade talks. Meanwhile, China has been gradually reducing its holdings of US treasuries, reflecting ongoing trade tensions and efforts to diversify its reserves.

What the Growing Debt Means for the Average American

For the average American, the growing national debt can lead to increased government spending on debt interest repayments. As more funds are allocated for debt servicing, there could be cuts to other areas of public spending. The government may also raise taxes to generate more revenue, which would affect citizens directly.

Increasing debt levels can result in higher interest rates across the economy. This could make mortgages, car loans, and credit card debt more expensive for average Americans. Thus, the rising national debt directly impacts the financial well-being of individuals in the US.

Follow 10x Times for more business news.