Tencent has again demonstrated its reign in the tech sector, with Tencent revenue increasing 13% in Q1 2025, even in the face of a slowing Chinese economy. The firm posted the revenue of Tencent of 180.02 billion yuan (approximately $25 billion), beating analyst estimates. The increase was led mainly by its gaming behemoth segment and strategic investments in AI, cloud computing, and overseas ventures. With net income up 14% to 47.8 billion yuan, Tencent revenue growth confirms its dominance of the world’s digital economy.

Read More: Drug Pricing Shake-Up: Trump’s Global Impact Sparks Pharma Price Fears

Gaming Momentum Drives Tencent Revenue to New Highs

Gaming has been the major driver of this increase in the revenue of Tencent. Long-term franchise focus and continuous updates by the company have resulted in huge user activity in titles such as Dungeon & Fighter Mobile and Delta Force. Future launches like Honor of Kings: World, and Chinese editions of Path of Exile 2 and Goddess of Victory: Nikke, are all set to continue driving Tencent revenue in subsequent quarters. With strong user stickiness through “evergreen franchises,” Tencent ensures consistent Tencent revenue streams that withstand economic downturns.

The company’s gaming franchise places it as the world’s largest video game company. In 2025 alone, its stock has appreciated by over 20%, mainly on investors’ faith in steady Tencent revenue growth through gaming. This lead becomes particularly important in times when other industries encounter volatility.

WeChat, Social Media, and AI Open New Revenue Channels

Although gaming is still dominant, Tencent revenue also takes considerable momentum through its social media offerings, most notably WeChat. With its broad user base, WeChat’s new features like mini-games, TikTok-style shopping, and digital gifting boost user engagement and monetization potential, ultimately driving Tencent revenue. While there has been some mixed reaction from users, these innovations are central to Tencent’s shifting business model.

The firm is also moving rapidly to grow its AI capabilities, such as investments in the DeepSeek R1 model and new uses like Yuanbao—Tencent’s response to ChatGPT. These initiatives are already assisting Tencent in transforming its identity from simply gaming and social media, paving the way for more diversified Tencent revenue streams.

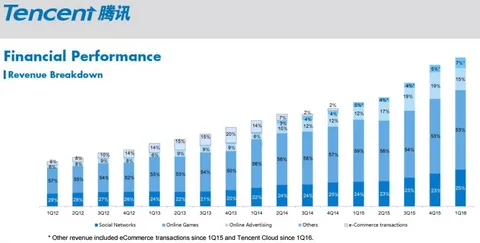

Revenue from cloud services, fintech, and digital ads also comes into Tencent’s revenue, even if they are sensitive to industry-wide market fluctuations. Nevertheless, Tencent’s diversified strategy toward emerging technology and consumer platforms allows it to derive stable Tencent revenue from diverse verticals.

Also Read: Gulf Stocks Surge Ahead in Emerging Markets with Bold Reforms

Global Expansion and Strategic Investments Drive Growth

Tencent’s aggressive international expansion is also fueling Tencent revenue. Tencent’s $1 billion investment in a 25% stake in a new Ubisoft IP-holding company is its pledge to conquer the world in gaming. Such franchises as Assassin’s Creed, now being localized for mobile by Tencent, may unlock enormous global Tencent revenue streams.

Besides, Tencent’s international footprint in AI, advertising, cloud computing, and fintech expands further, making sure that it’s not too dependent on the Chinese market by itself. These strategic international plays make Tencent revenue stable and scalable in the long term, even as other companies struggle with limited domestic opportunity.

Tencent’s capability to spot future-oriented investment prospects has always enabled it to outshine others. The organization is not merely responding to trends—it is creating them, and that means increasing Tencent revenue with every quarter.

Key Insight

Tencent is not merely surviving a bad economy—it’s prospering. With dominant gaming franchises, pioneering AI integrations, expanding international footprint, and diversification-rooted vision, Tencent revenue keeps increasing. As the tech industry in China heats up, Tencent’s steady innovation stays ahead of the pack.

For More Trending Business News, Follow Us 10xtimes News